Stamp Duty in NSW

Table of Contents

Stamp Duty Guide for NSW Homebuyers

Buying a house is a substantial cost and things can add up. A big part of these costs is the Stamp Duty. Stamp Duty is charged anytime you purchase a home in Australia. It is charged differently in each state.

It is also referred to as transfer duty. That means before you buy, you should have a clear idea of the amount, as this should be included in your overall budget. The amount to be paid is also subject to various discounts and exemptions. To help prospective homebuyers save when buying a new property, we made this guide outlining all the pertinent points.

Stamp Duty Law in NSW

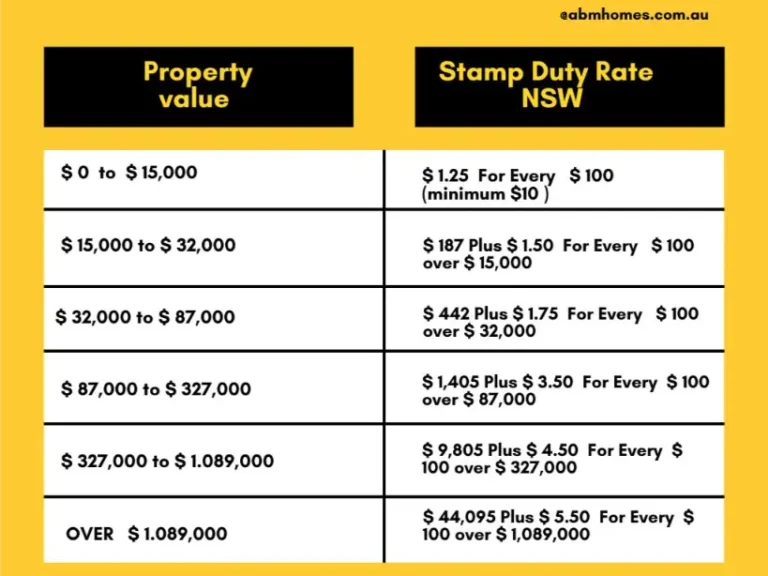

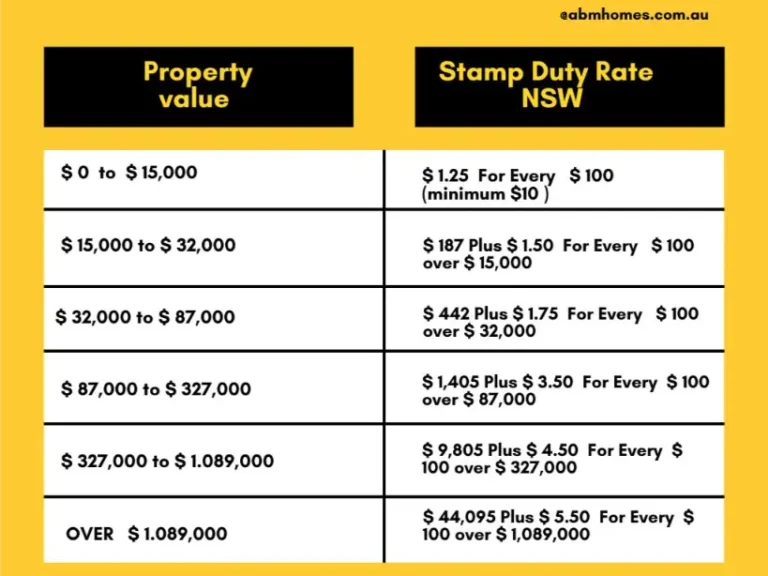

Stamp Duty is calculated as per the value of the property. It must be paid within 3 months of purchase, or you will be subject to fines by Revenue NSW.

In case you purchase a turnkey project from a builder like ABM Homes, this can be deferred for upto 12 months or property handover.

As there are nominally two kinds of value (market value and sale price), the higher one is chosen for the calculation.

NOTE: For luxury properties over $3 million, you have to pay Premium Stamp Duty: $175,830, plus $7 for every $100 over $3,505,000

This has caveats, and is best calculated with a trusted developer like our team at ABM Homes, who can help you figure out how to save, based on the property’s location.

Stamp Duty Law for First Time Homebuyers in NSW

The NSW government announced in 2022 that as per the FirstHome Buyer Choice Scheme, first time home buyers would get a new option, to pay the stamp duty in annual property tax increments.

This rule no longer applies as the NSW government discontinued it as of July 2023 and replaced it with a new (full) exemption. Unless you have already availed it, it is no longer applicable.

Before we discuss the new rules, let’s have a look at the FirstHome Buyer Choice Scheme.

Here is what this means in a nutshell:

- As of January 2023, new homebuyers can forgo paying upfront and instead pay an annual property tax.

- The rule only applies to properties under AUD 1,500,000.

- It is not applicable for anyone who has already purchased a property before.

To the earlier Headline New Exemption to Stamp Duty for First Time Homebuyers (as per July 2023)

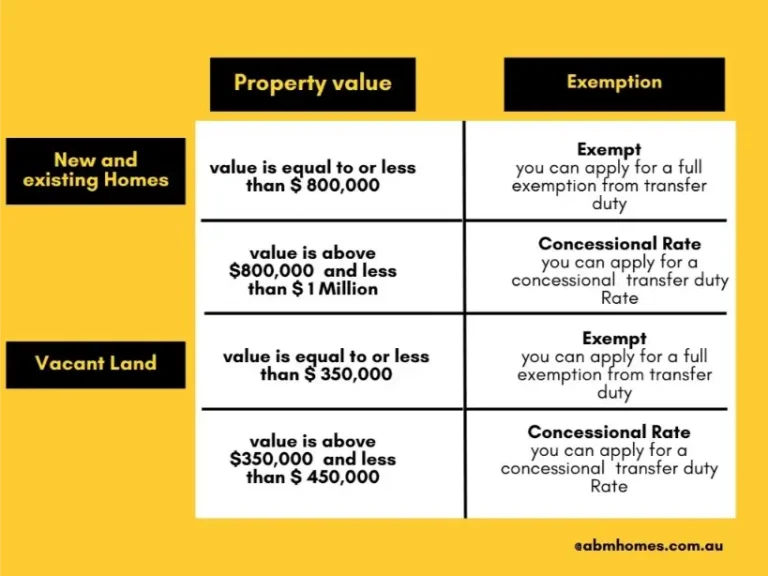

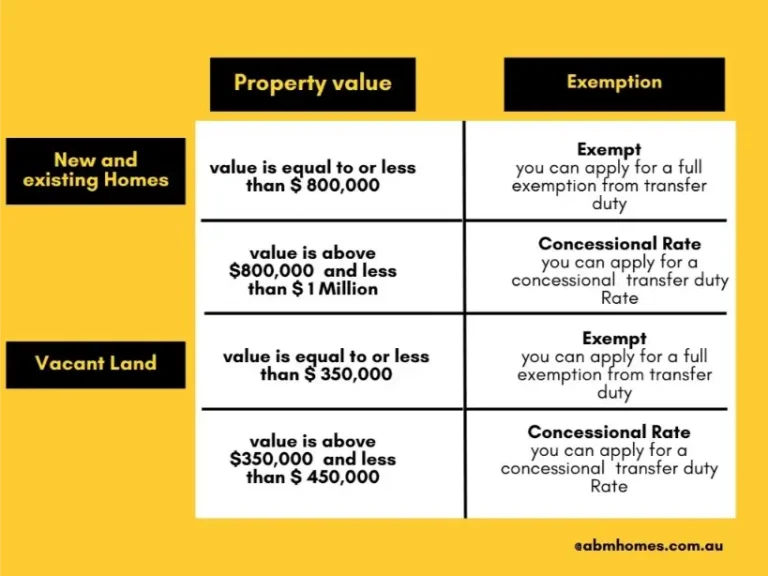

As per the new rule, here are the key takeaways:

- Eligible buyers can apply for an exemption if they’re buying newly built homes up to a value of $800,000.

- This is an increase from the earlier threshold of $650,000.

- There are some concessions that will decrease stamp duty if your property is valued between $800,000 and $1 million.

- If you are purchasing a vacant lot, you get an exemption for land valued up to $350,000 and a concessional rate for land valued over $350,000 and less than $450,000.

If that was too many words, here is a handy graphic you can refer to:

Concessions and Exemptions on Stamp Duty in NSW

First Home Owner (New Homes) Grant

To help new homebuyers, the NSW government helps out with a one time $10,000 grant on newly built properties under $600,000.

If you’re construction on a lot with a builder, the limit changes to below $750,000 (including construction cost).As this Grant is subject to lots of conditions and rules, this ios best discussed with a builder or the official government website.

Stamp Duty Law in NSW for Foreign Buyers

For foreign buyers, the government charges an extra 8 percent surcharge on Transfer Duty paid.

Stamp Duty Payment Method in NSW

To pay stamp duty in NSW, you have several options like direct deposit, cheque, or credit card. You’ll typically receive a notice from the Land Registry Service (LRS) or Revenue NSW, either at your new property’s address or by email. This notice will include:

1. The total amount of stamp duty due.

2. An explanation of how the tax was calculated.

3. Any concessions or exemptions applied.

4. Various payment options.

5. The due date for payment.

6. Details on late payment penalties or additional charges.

7. Reference information for the notice and payment.

ABM Homes: Your Guide to Smart Property Investment in NSW

Discover the ease of navigating stamp duty with ABM Homes, a leader in NSW construction projects!

Interested in a smoother, more affordable property journey? Reach out or visit our team at ABM Homes – we’re excited to guide you every step of the way!

We can also help you buy in cool locales at the best prices with our specially tailored House and Land Packages

Karandeep Singh

Karandeep Singh is the Operations Manager at ABM Homes with diplomas in Project Management and Building and Construction. Off-duty, he's smashing ping pong balls or hitting cricket sixes. A construction geek, he loves untangling concepts for others.

Karandeep Singh is the Operations Manager at ABM Homes with diplomas in Project Management and Building and Construction. Off-duty, he’s smashing ping pong balls or hitting cricket sixes. A construction geek, he loves untangling concepts for others.